Dan Lynn is the co-founder of ZUZU Hospitality Solutions, a distribution and revenue management company for small independent hotels. Englishman Lynn has lived in the US and Asia for the last eight years, with most of that time spent working in online consumer travel for companies including Expedia and HomeAway.

Dan Lynn is the co-founder of ZUZU Hospitality Solutions, a distribution and revenue management company for small independent hotels. Englishman Lynn has lived in the US and Asia for the last eight years, with most of that time spent working in online consumer travel for companies including Expedia and HomeAway.

Two years ago he started ZUZU – because he felt that “hoteliers were getting increasingly overwhelmed with the complexity of working with online travel platforms”. In preparation for his talk at TD’s GM Executive Summit, we caught up to chat for this week’s TD Podcast – below is an abridged version of that conversation. Lynn speaks:

Background

Background

I used to work for McKinsey in the UK but I really wanted to get into the travel industry. When the lead travel Partner left McKinsey to join Expedia in the States, he said, ‘This is exciting you should come and work for me!’.

So, aged 24, I moved to Seattle to take a strategy manager role at Expedia. It required doing whatever needed to get done; the company was going through its first growing pains as it had been a huge startup success story but was beginning to plateau.

It was a big turnaround time; we had just started to launch a few sites in Europe but it was all run very regionally.

My former partner had been asked to create a global supply organisation called PSG Partner Services Group. This is where we started recognising that we were a two-sided marketplace, not just a consumer-facing business.

The biggest change moving to Expedia is the sense of ownership. When you move from being a consultant to being part of the team and having that continuum of recognising there’s a problem, understanding the problem and coming up with a solution and then implementing it, and seeing that manifest itself, is immensely satisfying.

There’s an endorphin rush associated with ownership and being able to shape something and deliver it. When you start your own business it’s 100% about that.

I spent four years in Seattle – London is the only place that makes the Seattle weather look like a step up! – going from a dogsbody role then later pulling together Expedia’s global analysts into a team to create statistical analysis for things like fraud prevention. Then I moved to search marketing then I received the opportunity to move to Sydney and lead the business for Expedia Asia-Pacific.

I spent four years in Seattle – London is the only place that makes the Seattle weather look like a step up! – going from a dogsbody role then later pulling together Expedia’s global analysts into a team to create statistical analysis for things like fraud prevention. Then I moved to search marketing then I received the opportunity to move to Sydney and lead the business for Expedia Asia-Pacific.

We had recently launched Japan and India; it was incredibly exciting and I was very fortunate to receive the opportunity. It’s one of the things I really admire about the company: it gives people opportunities and it lets people make mistakes. As long as you don’t make the same mistake twice and make more good decisions than bad decisions, you get a lot of scopes to try things.

Expanding Expedia into Asia

A year later, we were the third or fourth largest player in Australia but we were growing faster than anybody else. The Japan business wasn’t doing as well and we had a major competitor in Rakuten travel. It became obvious that if Expedia was to have a great future in Asia-Pacific it needed to be in Asia – operating from Australia wasn’t going to work.

It made sense to shift our headquarters up into the region and we started having conversations about a more aggressive move to solve some of the secular issues. I felt that in Europe the sites that the low-cost carriers did not participate in OTAs as these companies made so much money in ancillary revenue. It cramped the growth of the model.

“Seven days locked in a hotel room in Hong Kong with Mark Okerstrom from Expedia and Kathleen Tan from AirAsia”

Instead, we wanted to attract low-cost carriers to be part of the platform and eventually we went into a joint venture with Air Asia who took a 50% stake in the business. It was a powerful idea and required seven days locked in a hotel room in Hong Kong with Mark Okerstrom from Expedia and Kathleen Tan from AirAsia. It no doubt accelerated Expedia’s entry into the market: we launched 13 new countries in the 18 months after that deal.

HomeAway

The autonomy from Expedia fed my risk appetite and I briefly started something with a friend, but then I took a year off while my wife gave birth. Travel was too in my blood to move away from and an opportunity at HomeAway came up.

They had recently turned to Asia-Pacific and had just bought three companies: Stayz in Australia, Bookabach in New Zealand and Travelmob in Singapore. I was an early-stage investor in Travelmob and so I got to meet Carl, one of the HomeAway co-founders. Later he asked me to come in and help.

“Find the balance between local and global solutions”

There was a need to add some global solutions to the local products they had and they wanted to try new approaches for the early-stage Asian markets. I think you have to find the balance between local and global solutions for any business.

It’s still very early days for a lot of these markets in Southeast Asia; for example, in Indonesia, online hotel bookings only make up 10% of the marketplace. Low-cost carriers were very quick to go online but hotels weren’t; I think this why companies like Traveloka still have a lot of scopes to grow fast.

They timed their heavy investment at the right point, just as it was starting to take off. They have been spending very aggressively because I think they are focused on the lifetime value of customers. They are thinking, ‘We might lose money on the first transaction but if we can be what online travel means to the Indonesian consumer then they will start coming directly the second and third time’.

Traveloka is also been very smart to focus on local, for example with payment solutions you need to accept money through ATMs or at shops or paying at the hotel directly.

The start of ZUZU

Coming back to the internal motivator that was the ownership of having an idea and getting it over the line, I feel I had always known I was going to build my own business. I had said to myself, by age 35 I would build my own business. I knew that the longer you stayed in corporate, the more you got used to the certainty of a paycheck.

Coming back to the internal motivator that was the ownership of having an idea and getting it over the line, I feel I had always known I was going to build my own business. I had said to myself, by age 35 I would build my own business. I knew that the longer you stayed in corporate, the more you got used to the certainty of a paycheck.

But for me it was never about the title or the paycheck; it was about being able to turn an idea into something and build something. I gave myself a firm deadline because otherwise there’s always a reason to stay at your company – for the next stock option grant or the next project.

“A farmer, a fisher, or in tourism”

I grew up in Cornwall, where you are either a farmer, a fisher, or in tourism and I always wanted to be a hotelier.

I got together for a coffee with the man who would become my co-founder Vikram Malhi, whom I had worked with at Expedia. He was based in the US for Hotels.com and then he came to Asia when we were starting Expedia India.

When I left Expedia he was effectively running all of the Expedia brands in Southeast Asia. During coffee, he said he needed to start his own business. I had gone to have coffee with the idea of asking him to join HomeAway!

We started talking about things we were passionate about. I had always had this nagging thought that you shouldn’t do a travel start-up because too many people love travel and there’s always a pain point in the booking experience.

There are too many travel startups that fail – it’s too crowded. But travel is the thing that we were passionate about and we couldn’t get away from it.

We saw what Oyo was doing in India and they noticed that there was a lot of mess in the independent hotel segment and there wasn’t uniformity of solution. In just that one country that segment covered tens of thousands of hotels.

The hotel industry is not at all consolidated and there’s a long tail of hoteliers owning one or two properties of 30 to 70 room – that’s the bulk of the industry. There were good performers and weak performers, and we felt like there was something we could do. By building something for the hoteliers, a B2B solution, we felt we could really create value.

In January 2016, in the process of going out and talking to hoteliers about joining the first platform we created – a booking site which we cancelled after six months – we spent more time with independent hoteliers and we got a much clearer sense of challenges were and how we could help them.

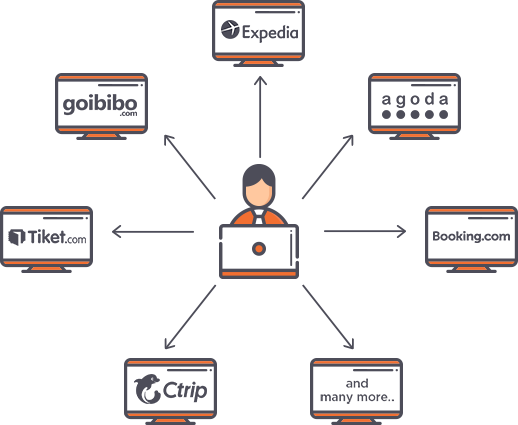

Six months later we signed our first hotel on what is now our business, which is all behind the scenes. We will do everything that your back office needs to do to generate revenue. That includes a small amount of work with your direct website but mainly includes optimising the way that you work with platforms like Expedia.

We know the behaviour that is rewarded by those platforms and what behaviour was punished by those platforms. We look at everything from, for example, where are you in the sort listing now on Expedia and why are you there. We have a deep understanding of the algorithms that Expedia and others use.

“When you’re not being punished by any of the OTAs you see yourself move up the sort orders”

Parity is important: all the OTAs are carefully watching the other OTAs and if they find that you are giving somebody else a better rate or better availability – which may just be an accident because you’re managing through extranet – any breach of the rate parity is punished. When you’re not being punished by any of the OTAs you see yourself move up the sort orders.

Then we start putting in place our revenue management principles, such as new rate plans, promotional structures and dynamic pricing. After three hotels, we realised that this was something that could drive 30 40 50% revenue growth for our partners.

In the traditional hotel chain model, you want to find a brand, then a 15- to 20-year management contract, and a heavy amount of capital expenditure upfront to make your hotel look like every other hotel in that chain. They will then do the revenue generation for you. We’re saying you don’t have to do those first three steps – and you don’t have to give up operation of your hotel – to get somebody to professionally deliver the revenue management for you.

We find in smaller hotels, you probably can’t even afford to have a director of revenue management or director of sales so it’s often the GM who is trying to do all that stuff in their spare time, for example struggling with an Excel spreadsheet on a Wednesday night.

New markets

We wanted to prove that we could create value for a hotelier across different types of markets not just developing or developed markets. The first two markets we focused on Indonesia and Taiwan because we wanted to have proof that we could create value in markets that were early in the online travel adoption and later in the online travel adoption.

Indonesia is seeing 6 to 7% growth in its economy every year which means that the travel sector is growing at one and a half times that which means that online travel is going up two or three times that so it’s just such a vibrant fast-moving market. It’s also an enormous market so if you can find a small segment where you really create value, you can deliver a lot.

Of course, part of picking markets is about people and in Taiwan, we knew a phenomenal leader: Ivy Hsieh, a Taiwanese woman based in Hong Kong who wanted to move back to Taiwan and wanted to build the business with us.

Taiwan is a really developed market that is often ignored by so many companies. Maybe there’s a feeling that the mainland China players are going after it so the international community doesn’t go there and maybe the Chinese players feel that they would have to tweak their product and it’s not big enough market so it’s not worth it. But I’ve always found that if you can build a relationship that creates value, it’s a rational market where you can have a great business and make money.

Taiwan is a really developed market that is often ignored by so many companies. Maybe there’s a feeling that the mainland China players are going after it so the international community doesn’t go there and maybe the Chinese players feel that they would have to tweak their product and it’s not big enough market so it’s not worth it. But I’ve always found that if you can build a relationship that creates value, it’s a rational market where you can have a great business and make money.

More recently we have started to expand so we now have hoteliers in Singapore, Thailand and Malaysia and we will add new markets steadily as we grow the business.

What’s coming up

We want to continue to invest in our product solution. We see ourselves as trying to strip out a lot of complexity and one of the complexities that exists for hoteliers is having five to six different operating systems that all have to talk to each other. We continue to progress our technology platform so that it can be a single solution; we’re trying to build a product that lets a hotelier use it the way they want to use it for his or her property.

We’re also looking into machine learning on the revenue management side. We are building a team of data scientists whose job is to build a revenue management model that takes into account historical demand current competitive pricing, airline ticket availability. It’s a huge opportunity.

Lynn will be talking about third-party distribution and how to use those channels effectively at the GM Executive Summit next week.

share

share