Latin America’s populations are getting tech-savvier, leading to a boost in online bookings and Internet penetration. Looking forward, four in 10 sales will be made online in the region by 2020. Phocuswright’s Latin America Online Travel Overview Third Edition features rich analysis of the Latin American travel market, with coverage of online versus offline bookings by travel segment and channel.

E-commerce is on the rise, and online travel penetration will grow an average of ten percentage points in the coming years. Although the online travel market took a dip in 2015, online bookings will grow at two to four times the pace of the total market through 2020. Online sales will exceed 2014 levels by 2017 and are projected to reach US$29.5 billion by 2020.

(Click image to view larger version.)

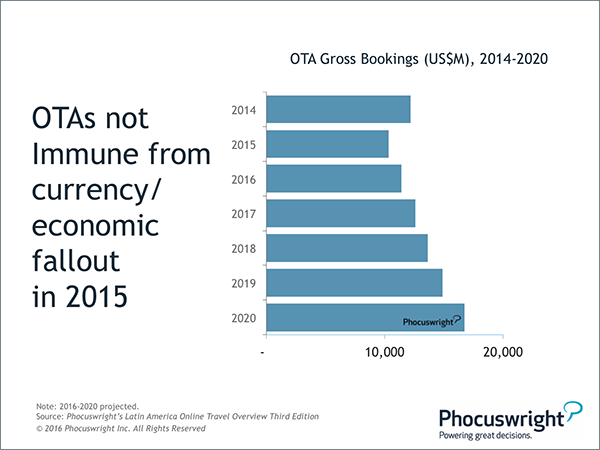

Growth in e-commerce has led to a boom in online travel agency (OTA) growth. OTAs such as Despegar, ViajaNet and Best Day collectively registered $10.3 billion in point-of-sale bookings in 2015 and will keep growing at 8%-12% each year until 2020.

(Click image to view larger version.)

“The strong consolidation movement seen in other parts of the world is happening in Latin America as well,” said Phocuswright’s research analyst, Brandie Wright. “Priceline and Expedia are fighting hard to get market share in the region, mostly through local acquisitions and partnerships. Expedia invested $270 million in the LATAM’s largest OTA, Despegar, and Priceline invested temporarily in Hotel Urbano.”

Priceline’s Booking.com is growing in popularity in LATAM countries, alongside regional players. ViajaNet is quickly gaining market share in the region with an expected growth rate of 20% in 2016. Best Day, the biggest OTA in Mexico, is expected to double its business by 2020.

Brandie Wright – Research Analyst

Purchase Phocuswright’s Latin America Online Travel Overview Third Edition for the insight you need to make informed decisions about the region’s dynamic travel market.

share

share