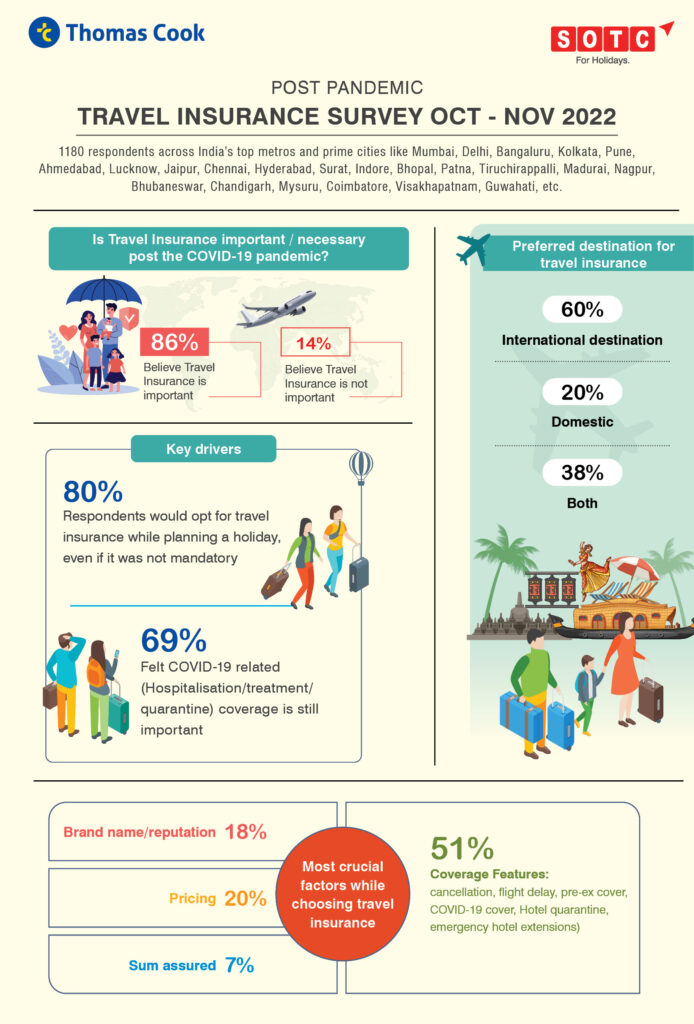

Thomas Cook (India) Limited and its Group Company, SOTC Travel’s recent survey reveals significant customer requirement for travel insurance for both international and domestic destinations. The survey covered over 1000 consumers spread across India’s top metros and prime cities like Mumbai, Delhi, Bangaluru, Kolkata, Pune, Ahmedabad, Lucknow, Jaipur, Chennai, Hyderabad, Surat, Indore, Bhopal, Patna, Tiruchirappalli, Madurai, Nagpur, Bhubaneswar, Chandigarh, Mysuru, Coimbatore, Visakhapatnam, Guwahati, etc. While the pandemic created increased need for travel insurance, the continued demand reflects the growing maturity of the Indian market.

The data analysis has revealed valuable insights on customer requirements related to travel insurance:

Strong requirement: 86% respondents showcased travel insurance as a necessity in the post pandemic era as compared to 75% respondents highlighting Health & Safety as the primary concern from the First Holiday Readiness Travel Report (May 2020); while 80% are keen on availing travel insurance for themselves/their family even if it was not mandatory during their travel or while obtaining visas

Covid 19 coverage: Covid 19 related coverage including hospitalisation, treatment, quarantine is essential for 69% of the respondents while planning their travel

Insurance preference: Significant share of insurance preference is for international destinations (60%) while 38% respondents are interested in taking travel insurance for both domestic and international destinations; from less than 1% pre pandemic to approx 20% currently for domestic destinations

Crucial factors while selecting travel insurance: Features – insurance coverage features such as cancellation, delay, pre-existing medical conditions, Covid 19 cover, hotel quarantine, emergency hotel extensions continue to be a top priority for over 50% of the respondents while considering travel insurance. Coverage costs – expenses play a major role while considering travel insurance as 20% indicated that the insurance pricing should be reasonable.

Sum insured – it is essential too as highlighted by 7% of the respondents. Insurance company – the name of the insurance company or reputation in the market is considered important by 18%. Additional factors – claim settlement percentage, cashless hospitalisation, flight/trip cancellation, hassle free reimbursement, delay, lost luggage/theft and reliability are also important factors

Abraham Alapatt, President & Group Head – Marketing, Service Quality, Value Added Services & Innovation, Thomas Cook (India) and SOTC Travel said: The pandemic changed several norms in the travel industry with health and protection gaining importance. The fact that customers continue to see value in comprehensive travel insurance is to my mind, less an indicator of continuing concerns about the pandemic and more to do with a more mature customer mindset. This is more akin to customers in mature economies, where travel insurance is seen as a must have and not just good to have.

Given India’s rapidly maturing economy – our customers understandably, are seeing value (beyond thepandemic) in comprehensive travel insurance to ensure their safety and security while travelling.

share

share